In terms of stopping fraud, banks and different monetary establishments have their work minimize out for them. Not solely is monetary fraud on the rise, however it’s additionally getting tougher and dearer to cease because the funds trade continues to diversify by embracing real-time transactions.1

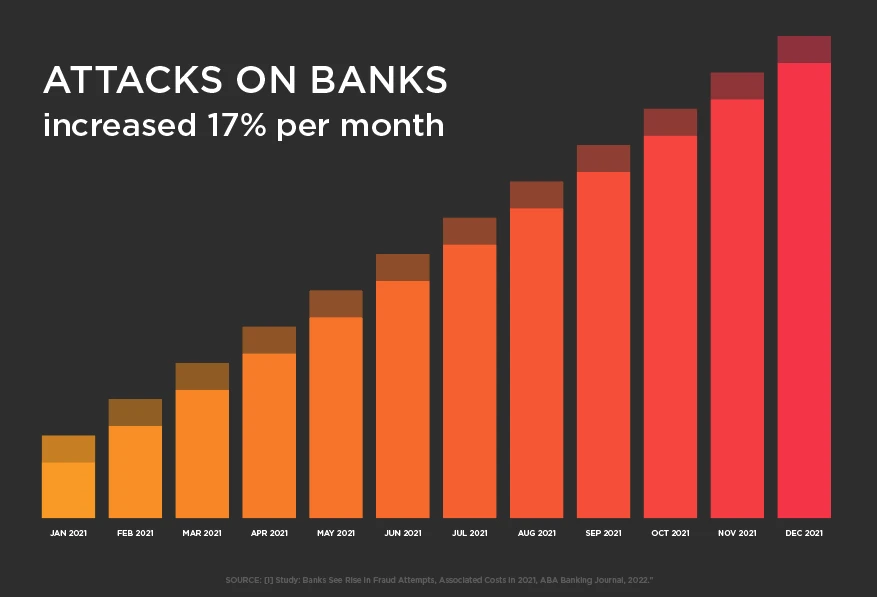

In keeping with reporting within the ABA Banking Journal, assaults on banks elevated 17% per thirty days between 2020 and 2021.2 In the identical timeframe, prices rose from $3.64 per greenback misplaced to $4.00. Labor and investigative prices make up a considerable portion of those losses. With yearly fraud losses within the a whole lot of billions and rising worldwide, these per-dollar prices can minimize revenue margins considerably.

It’s because most monetary establishments nonetheless depend on extremely educated analysts to identify fraud. With extra real-time transaction processing simply on the horizon, it can turn out to be not possible for these analysts to maintain up. Whereas there are automated fraud options available on the market, few if any can ship the instantaneous detection, remediation, and accuracy that monetary establishments want.

Clever fraud detection with AI

To fulfill these challenges head-on, TIBCO, a pacesetter in enterprise intelligence, has developed its Related Intelligence Platform, which runs on Microsoft Azure. To identify fraud, Related Intelligence combines superior analytics and AI with pre-configured parts to investigate nearly any Azure knowledge supply.

The answer makes use of AI to enhance, relatively than exchange, human determination making. From the huge quantities of information flowing via the monetary system each day, it focuses the work of analysts on these transactions more than likely to be fraudulent. This helps decrease prices, enhance danger administration practices, and create happier clients.

How Related Intelligence works

Related Intelligence processes extra knowledge, sooner, utilizing cloud-native applied sciences together with Azure Occasion Hub and Azure IoT Hub for real-time streaming analytics and occasion processing. It then applies AI capabilities akin to pure language processing to show uncooked knowledge into actionable intelligence.

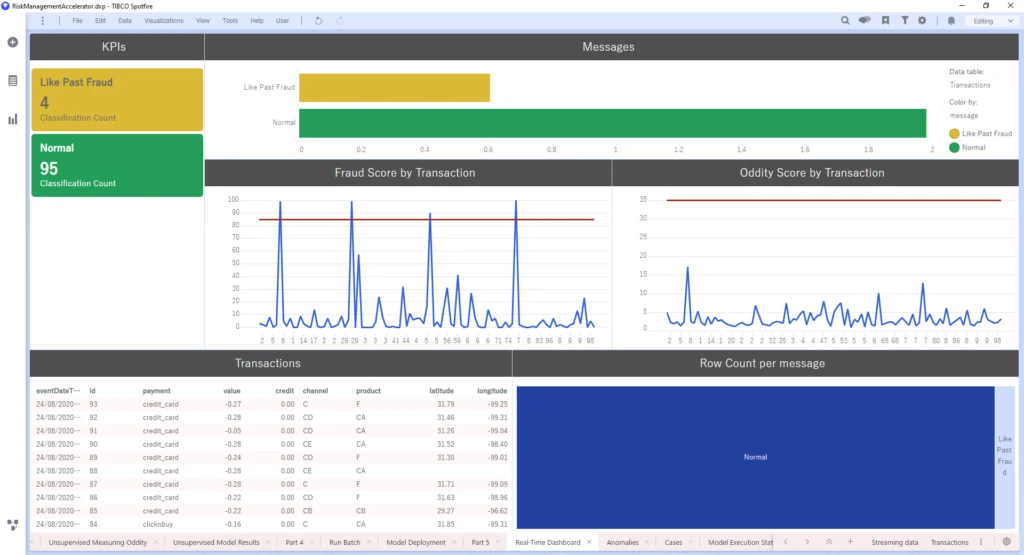

As a substitute of relying solely on a rules-based engine, the platform additionally analyzes knowledge utilizing each supervised and unsupervised machine studying fashions to provide a fraud chance rating. This rating is mixed with a second rating that exhibits how far the transaction deviates from the norm. Collectively, these two scores enhance the accuracy of fraud predictions.

To uncover relationships between people, accounts, and transactions, fraud analysts use superior visible analytics dashboards, interactive visualizations, dynamic filtering, and key phrase mining.

Utilizing these instruments helps analysts shortly uncover wider patterns of fraud that will point out a criminal offense ring at work. By together with behavioral and social community knowledge units, Related Intelligence can expose teams of individuals working collectively in methods which can be tough to detect. With out the assistance of AI, these connections can be practically not possible to identify.

The AI fashions inside Related Intelligence are extremely versatile, enabling clients to make use of them for a variety of use instances. For instance, Related Intelligence can be utilized to detect cash laundering, monitor debit and bank card transactions, and uncover insurance coverage fraud.

As a cloud-native answer, Related Intelligence is fast to provision, scales mechanically, and integrates with transaction applied sciences usually utilized by monetary establishments.

Modernize your fraud detection on Azure

With the monetary crime rising yearly, so are its prices. Monetary establishments, fee card processors, and banks mustn’t need to lose billions of {dollars} yearly to out-of-date strategies and options when the expertise they want is right here immediately.

Study extra about how your establishment can scale back fraud with anomaly detection expertise on Microsoft Azure.

Learn extra about TIBCO >

[1] Card trade faces $400B in fraud losses over subsequent decade, Nilson says, Funds Dive, 2021.

[2] Research: Banks See Rise in Fraud Makes an attempt, Related Prices in 2021, ABA Banking Journal, 2022.